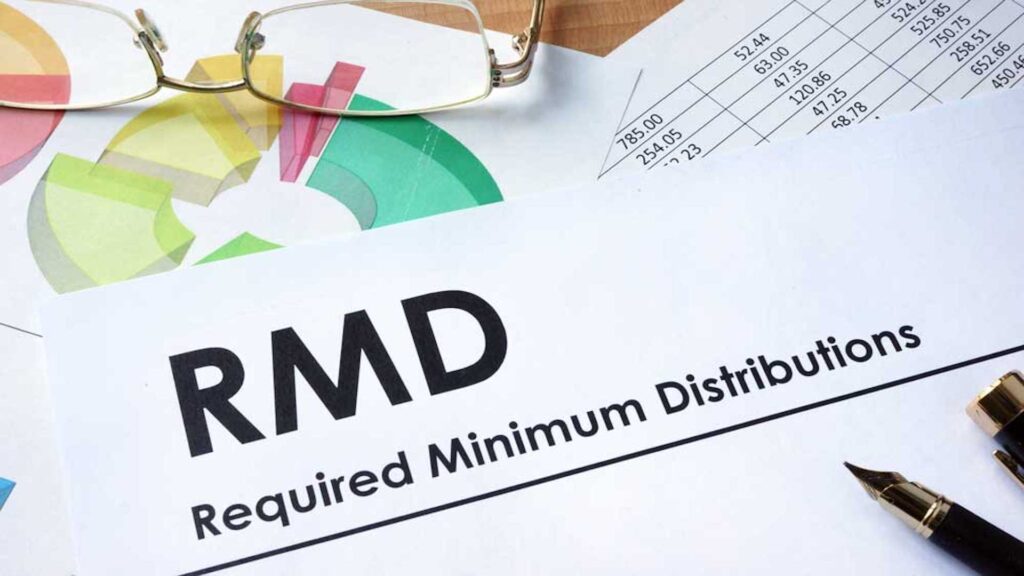

OBBBA Small Business Changes

This chart compares current business tax provisions with the changes under the OBBBA. It shows how the law impacts clean energy credits, employer incentives, business deductions, reporting requirements, and investment programs. Overall, it highlights which tax breaks are expanded, made permanent, or eliminated for businesses starting in 2025 and beyond.

OBBBA Small Business Changes Read More »